2023 Outlook

Goodbye TINA (There is No Alternative) – December 2022

Key Observations

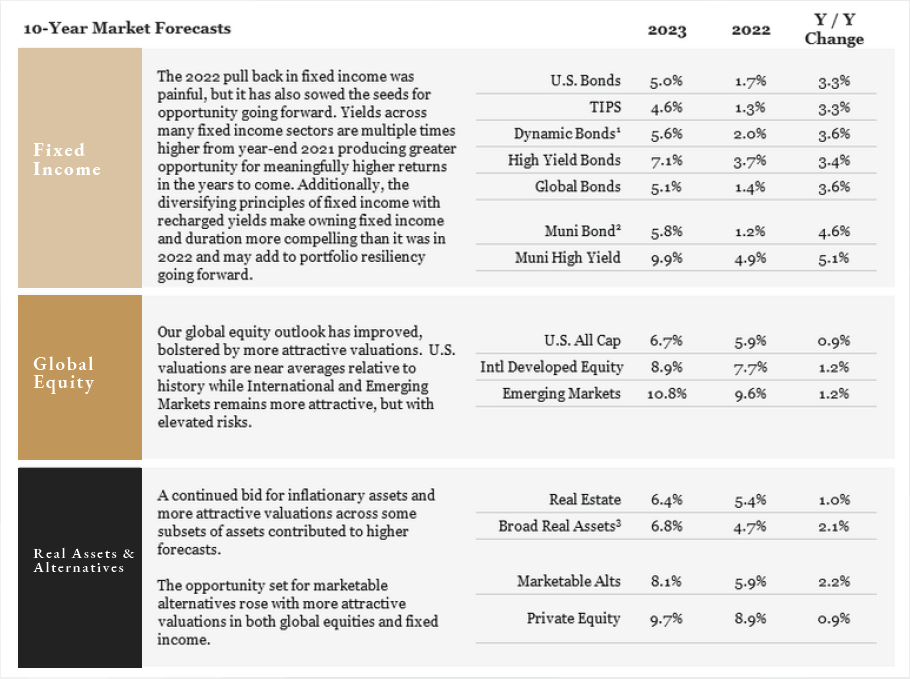

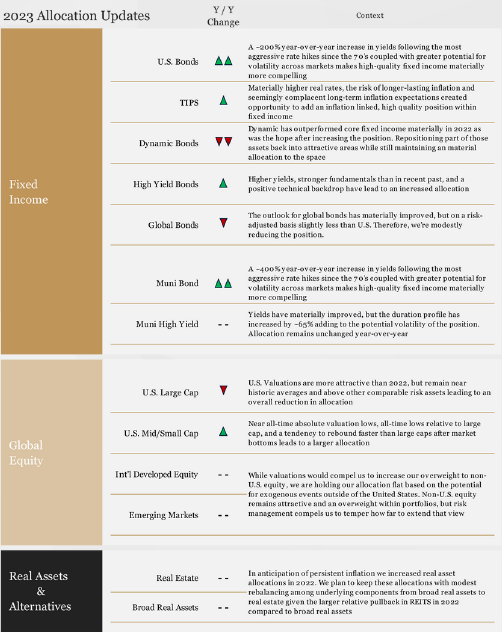

- Our capital market forecasts increased across all asset classes, most materially in fixed income given the change in yields over 2022.

- The three themes we see driving the market, Persistent Volatility, Moderating Inflation, and Bear Market Bottom, will come to life over different time periods in 2023 and beyond.

- Year-over-year we are adding to high-quality fixed income and high yield primarily by reducing dynamic bonds and increasing U.S. mid and small caps from U.S. large caps. We remain modestly overweight to non-U.S. equity but are not adding to the position.

Our investment views are based on a simple idea: as facts change, so may our outlook. The last few years have been an interesting period for this ethos as our annual outlook is beginning to feel like a game of ping-pong, oscillating between bulls and bears, as the environment shifts around us. Our 2021 outlook, Poised for Growth, discussed optimism as the proverbial economic doors swung open as COVID eased. Navigating Moderation, our 2022 outlook, moved in the other direction, calling for volatile markets based on (among other factors) persistent inflation, the Fed stepping on the economic breaks and market valuations and expectations set for perfection. In this outlook, Goodbye TINA (there is no alternative), we find ourselves on the other side of the market pendulum, seeing greater opportunity in 2023 albeit amidst a period of considerable uncertainty. Our outlook is tempered with humility and pragmatism, recognizing the future remains uncertain, as it always has. However, as the market dynamics have changed so have our opinions and we are excited to share our view for 2023 and beyond.

This report was prepared by Fiducient Advisors, a third-party vendor, and is intended for the exclusive use of clients or prospective clients of Visionary Wealth Advisors. The information contained herein is intended for the recipient, is confidential and may not be disseminated or distributed to any other person without prior approval of Visionary Wealth Advisors. Any dissemination or distribution is strictly prohibited. Information has been obtained from a variety of sources believed to be reliable though not independently verified. Any forecasts represent future expectations and actual returns, volatilities and correlations will differ from forecasts. This report does not represent a specific investment recommendation; and no portion of this communication should be construed as a solicitation to buy or sell any specific security or investment product or to engage in any particular investment strategy. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Past performance does not indicate future performance and there is a possibility of a loss. Visionary Wealth Advisors is an SEC-registered investment adviser that maintains a principal place of business in the State of Missouri. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about Visionary’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov.

Use of Indices and Benchmark Return Indices cannot be invested in directly. Index performance is reported gross of fees and expenses and assumes the reinvest dividends and capital gains. Past performance does not indicate future performance and there is a possibility of a loss. See the disclosure page for indices representing each asset class.

10-Year Market Forecasts

1) Dynamic bonds are a blend of 33% Cash, 33% Corp HY, and 34% Global Bonds. 2) Tax Equivalent yield based on highest marginal Federal tax rate (37%). 3) Broad Real Assets is 20% REITS, 20% Global Infrastructure, 20% Commodities, 20% US Bonds, 15% Corp High Yield, 5% TIPS

Source: Fiducient Advisors Capital Market Assumptions. Market and economic data including, but not limited to valuations, fixed income yields and inflation are used to derive forecasts. Outputs and opinions are as of the date referenced and are subject to change. Information is intended for general information purposes only and does not represent any specific investment recommendation. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. There is no guarantee that any of these expectations will become actual results.

For additional information on forecast methodologies, please speak with your advisor. Please see Index Proxy Summary information at the end of this paper for summary of indices used to represent each asset class.

2023 Themes

Rarely do market themes fit neatly into a calendar year and 2023 is no exception. However, there are three distinct themes in markets today which we believe are likely to unfold over varying time periods. Therefore, our views are presented as if they were three acts of a play. The first act is one in which changes are just beginning and will have long-term implications yet to be fully appreciated. The middle act is one in which change is obvious, but the resolution is not imminent. In the final act, we believe events are more likely to take place in the near term.

First Act: Persistent Volatility

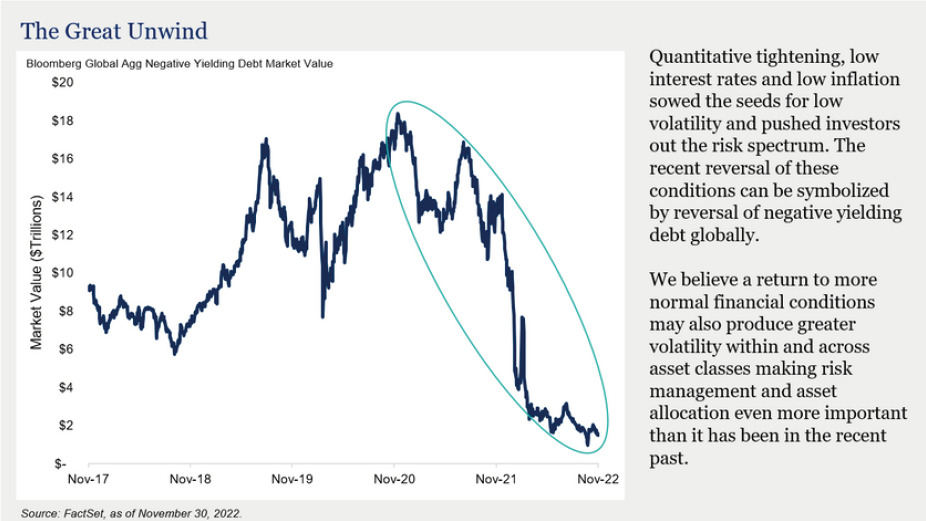

In the first act of a play, facts and circumstances are often revealed about a character which in time will shape their path, but careful attention needs to be paid to see how these early clues may shift their trajectory. We view the reversal of zero-bound interest rates and the unraveling of globalization as those pivotal moments leading to higher long-term volatility for both stocks and bonds.

The last 10+ years in markets have been unique compared to long-term history. One could describe markets since the Global Financial Crisis as having low-interest rates, low inflation, and low growth coupled with maximum accommodation and maximum liquidity. These conditions have led to abnormally low volatility and have encouraged additional risk-taking or TINA, the acronym for “there is no alternative” (to owning more equity). We believe that reversing some, but not all, of these conditions, may produce higher structural volatility across multiple asset classes. Additionally, these shifts may also mean that investors expecting the playbook of the last 10 years to be the same for the next 10 may be disappointed.

Portfolio Impact

Resiliency, risk management and humility all come to mind as important components of allocations. As a result, our 2023 allocations include increased exposure to high-quality and intermediate-duration U.S. fixed income. While fixed income has lacked its historical diversification benefits in 2022, we believe with recharged higher yields and greater volatility in equity markets, fixed income may retake its historical position of diversifying equity exposure.

Additionally, while valuations would compel us to continue to increase our overweight to non-U.S. equity, we are holding our year-over-year allocation flat based on the greater potential for exogenous events outside of the United States. Non-U.S. equity remains attractive and overweight within portfolios, but risk management compels us to temper that view.

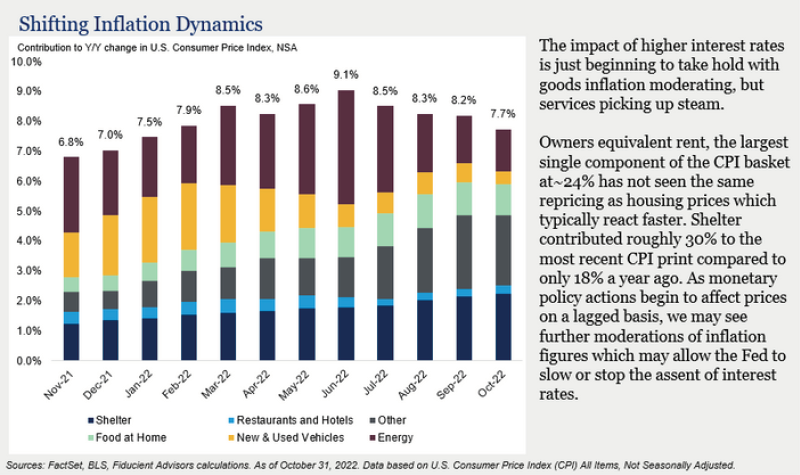

Middle Act: Moderating Inflation

In the middle of the play, rising conflict is obvious, but the resolution has yet to take hold. These inflection points often leave the audience uneasy about the future. Inflation, and the Fed’s role in moderating it, is in its middle act. It is unlikely the curtain will drop on inflation in 2023 falling straight to the Fed’s target of 2%. However, that is not what is required for a market bottom or for the Fed to pause. We simply need the path to resolution to be illuminated. So, while inflation may moderate over the years to come, its pivotal moment in market sentiment may be closer at hand.

Portfolio Impact

The good news/bad news of inflation moderating, but not immediately, highlights our points above regarding resiliency. The path is unlikely to be smooth, but seemingly in the right direction. We increased our real asset allocations coming into 2022 and we plan to maintain that increased position in light of inflation remaining above the Fed’s 2% target.

We are adding Treasury Inflation Protected Securities (TIPS), a financial asset that acts a lot like a real asset. The market is hyper-focused on short-term inflation but is seemingly complacent about long-term inflation, leaving room for opportunity in the middle. Such an allocation to high-quality inflation-linked bonds adds quality to the portfolio and potential upside if long-term inflation assumptions are too sanguine.

Final Act: Bear Market Bottom

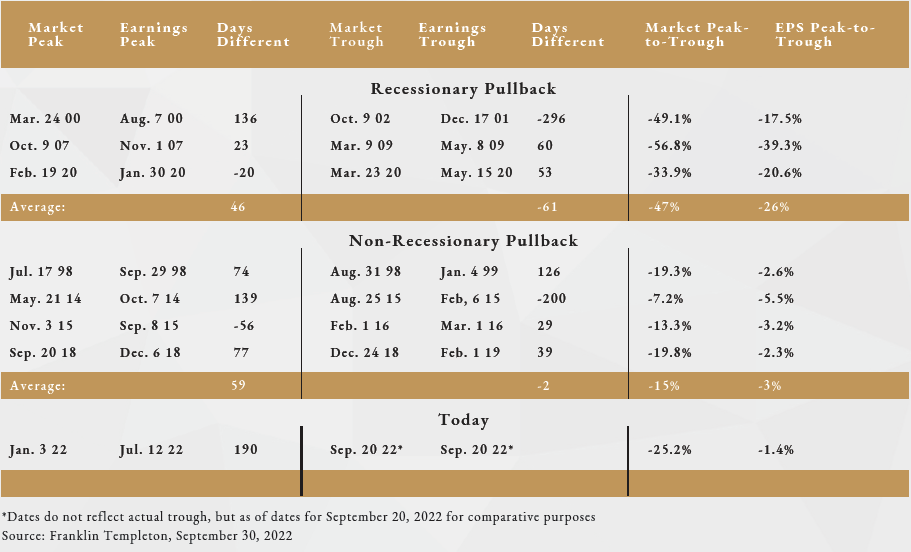

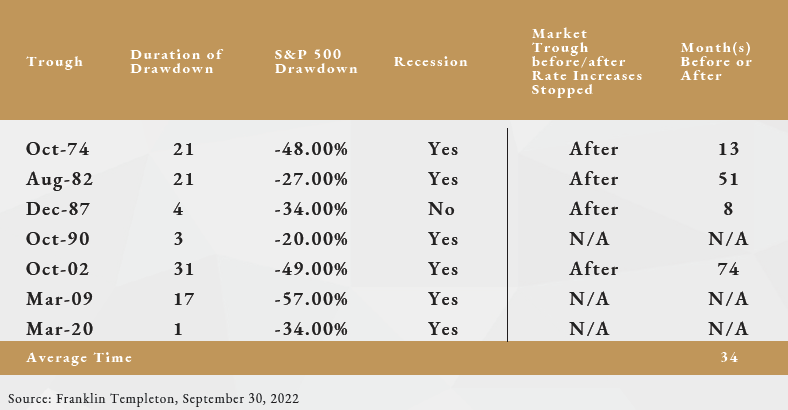

In the final act, we fully grasp the conflict and perhaps even see what is necessary for resolution but are uncertain quite how it will play out. We believe we are in a similar place with markets bottoming. Let’s first build context around bear markets. Since 1950, the average pullback of 20% or more has lasted approximately 14 months; the longest of these was 31 months from March 2000 to October 2002. The shortest drawdown was less than two months in 2020. While there is no such thing as an average bear market, with history as a guide, our 11-month-old bear market is likely closer to its end than its beginning.

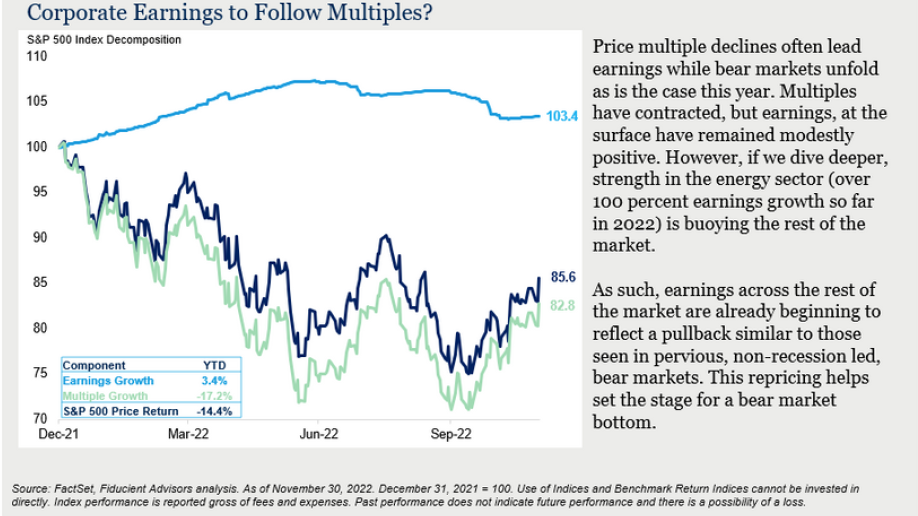

Now, how do bear markets typically unfold? The most common pattern is multiple contraction. This leads markets lower first, then the Fed ends a hiking cycle or begins an easing cycle and finally, earnings and expectations fall, creating a new base from which to build healthy forward expectations.

Index prices can be broken down into two primary components, earnings per share (EPS) and multiples. EPS is the economic value created by businesses and what investors are buying. Multiples are how much an investor is willing to pay for those earnings. Multiples are often driven by sentiment and are one of the first things reflected in prices. Corporate earnings, on the other hand, are backward-looking. Moreover, the impacts on businesses from higher interest rates and/or slowing demand takes time to appear in financial statements. Therefore, the typical pattern of bear markets is multiple contraction first, leading the market lower, followed by earnings.

This has certainly been the case in 2022. Multiple contraction has accounted for more than 100% of the pullback as earnings remain modestly positive so far in 2022. The question remains, what role will earnings play in the market bottoming this time around?

As shown in the table, there is a meaningful difference in the earnings impact in recessionary versus non-recessionary environments. Our expectation remains that if a recession takes place, it will be a modest and cyclically led recession rather than one driven by structural imbalances like during the Global Financial Crisis or an exogenous factor like COVID-19.

With that in mind, second and third quarter earnings are beginning to reflect a potential modest economic contraction. In fact, second quarter earnings ex-energy were down 4.0% (up 6.2% with energy) and third quarter earnings with 99%of companies reported show earnings ex-energy down another 5.0% (up 2.5% with energy) 1. Why ex-energy? Russia’s invasion of Ukraine propelled commodity prices up, pushing earnings for the sector up 137.31 % year-to-date. This is as unique the energy sector and is not reflective of the rest of the market. All of this compares to earnings expectations (as late as June of this year) of 10.8% earnings growth for third quarter 2022.2 We wrote in our 2022 outlook that these lofty expectations were a potential source of volatility as reality may not be as rosy and that has proven to be the case. All in, earnings are beginning to reflect the economic reality of a moderating economy. This is a healthy step forward for a bear market bottom and again suggests we are nearer the end than the beginning.

Finally, what role does the Fed play in all of this? To no surprise, given the Fed focus this year, an important one in our view. History has shown us markets tend to bottom after the Fed is done raising rates. Intuitively this makes sense. If the Fed is raising rates, they are proactively looking to cool economic activity.

Yet given their dual mandates of price stability and full employment, the operative word is cool, not kill. When the Fed sees modest success in controlling inflation, they will stop or pause. However, the full effect of higher rates takes some time to work through businesses and markets. It is a bit like turning the shower handle to change the temperature: you have to wait a second to see if you got it right. Therefore, businesses are often amidst contraction when the Fed stops increasing rates. It is certainly conceivable that the market bottoms before the Fed officially stops as it tapers back from 0.75% moves to 0.50% or less. However, the market is less likely to bottom if the Fed is accelerating or maintaining its hawkish stance.

Portfolio Impact

We have no ability, or need, to precisely call the market bottom. However, as we look forward, we believe it prudent to prepare for a potential market rebound. As such, we are increasing our weighting to U.S. small cap stocks and high yield bonds, recognizing they have historically led over large cap and investment grade bonds respectively in rebounds.

Additionally, a less hawkish Fed following a market bottom may moderate U.S. dollar strength and prove to be a tailwind for non-U.S. equity. Therefore, we are maintaining our overweight to non-U.S. equity but based on the greater potential for exogenous events outside of the United States we do not plan to increase it.

Portfolio Allocations

Final Thoughts

2022 was the reset button for many markets. Exiting zero-bound interest rate policies, moderating inflation and repricing global fixed income and equity have all helped sow the seeds for a brighter outlook in 2023 and beyond. While we anticipate volatile asset prices will persist in the years to come, leaning into newly created opportunities may prove to be the right decision over the long-term.